Beginner Budgeting Guide: Your First 30 Days

Budgets have a branding problem.

Most people think “budget” means eating sadness for dinner while your friends post vacation photos from Santorini. In reality, budgeting is just adulting with receipts.

And it matters because the numbers are ugly: about 60% of Americans are still living paycheck to paycheck, and that same report notes high financial stress plus widespread credit card debt. Translation: millions of people are one surprise tire replacement away from a full personality change.

This beginner budgeting guide is your first 30 days, mapped out like a training plan. Not a vibe. Not a spreadsheet cosplay. A system.

Meet Jordan.

Jordan makes decent money, still wonders where it goes, and has at least one subscription that charges monthly for the privilege of being ignored. Jordan tried budgeting once, quit around day 9, and decided budgeting “doesn’t work.”

Jordan wasn’t wrong.

The budget didn’t fail. The system failed.

Here’s how to build one that survives real life.

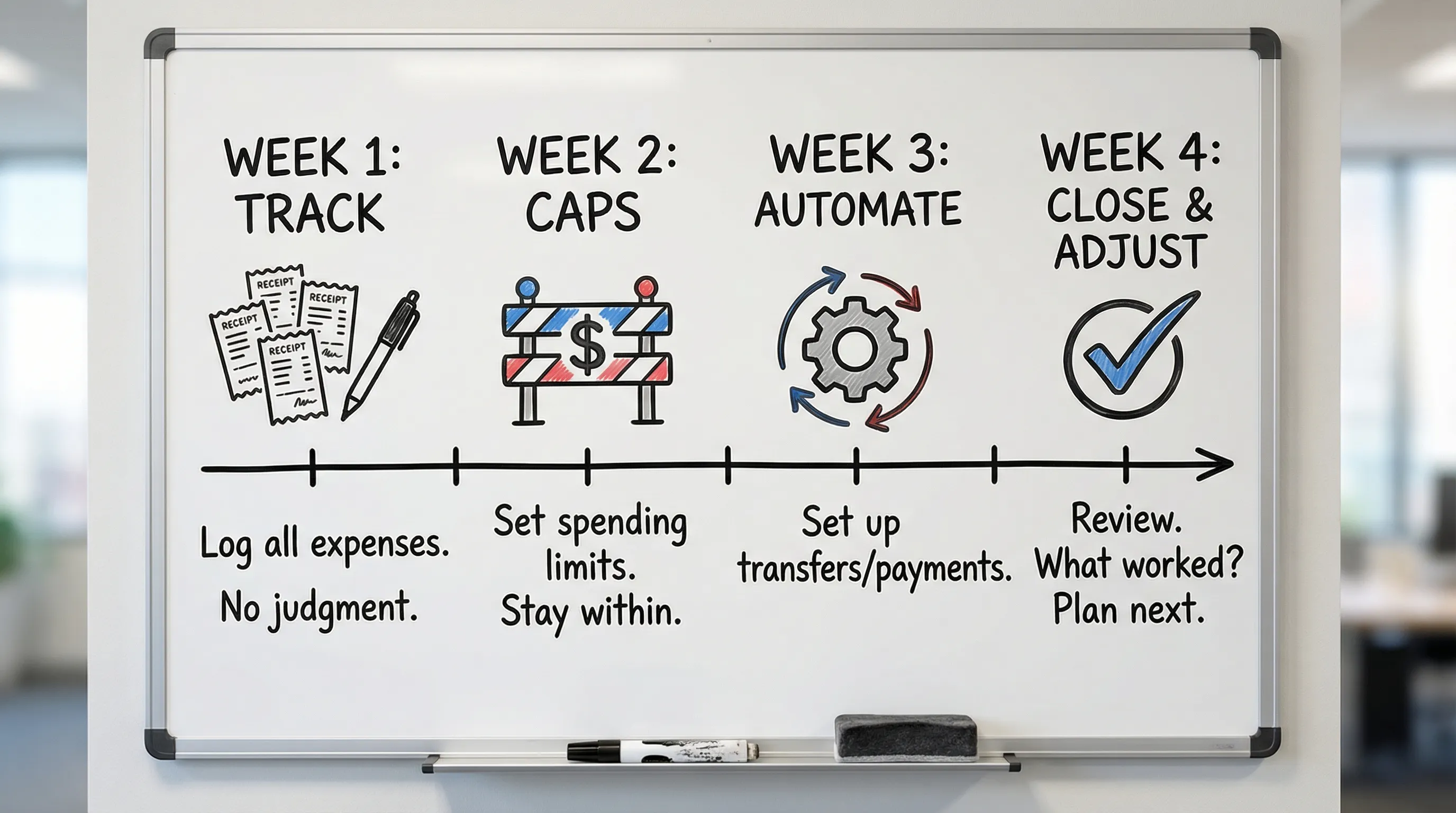

What you’re building in 30 days (so you don’t quit on day 9)

Your first month has one goal: turn money chaos into a repeatable routine.

By day 30, you should have:

- A clean view of income, expenses, and cash flow (no more “I think I spend like… $200 on food?”)

- A simple category setup you can maintain

- Spending guardrails (caps) that match reality

- A weekly check-in habit that takes 10 to 15 minutes

- A month-end “close” that helps you adjust without shame spiraling

Quotable truth: A budget is not a restriction. It’s a reality subscription you actually need.

The rules of beginner budgeting (the ones nobody puts on the cute printables)

Rule 1: Start with tracking, not policing

Beginners jump straight to “I will only spend $37 on groceries this month” and then wonder why life laughs.

Instead, do this first:

- Track everything

- Categorize it cleanly

- Learn your baseline

Then you set limits.

Rule 2: Fewer categories, more clarity

If your budget has 47 categories, you’re not budgeting. You’re building a museum.

A good beginner setup has 10 to 20 categories max. If you want a clean template, use this companion guide: Budgeting categories list: a clean setup that works.

Rule 3: Your budget needs a rhythm, not motivation

Motivation is a liar. Rhythm is a grown-up.

You need:

- A weekly check-in

- A monthly reset

That’s it.

If you want the deeper psychology, bookmark this: Why budgets fail (and how to fix yours in 2026).

Your first 30 days: the plan

This is the part you came for: what to do, when to do it, and how to avoid the classic “I set a budget and immediately got invited to three weddings” problem.

30-day beginner budgeting calendar (high-level)

| Timeframe | Focus | Outcome you want |

|---|---|---|

| Days 1–7 | Ground truth | Your spending data stops lying |

| Days 8–14 | Build guardrails | You can spend without guessing |

| Days 15–21 | Automate and stabilize | Fewer manual fixes, fewer surprises |

| Days 22–30 | Close the month | You learn, adjust, and repeat |

And yes, you can do this with a spreadsheet. You can also cut your own hair. Many people try. Few look happy.

If you’re using a modern tracker like FIYR, this is where it helps: income and expense tracking, customizable categories, transaction rules, subscription tracking, and a safe-to-spend style view all make the process dramatically less annoying.

Days 1–7: Get your “ground truth” (aka stop guessing)

Day 1: Pick your money HQ

You need one place where money reality lives.

Ex-Mint users: you don’t need to recreate Mint. You need something better than 2014-era “hope the categories work.”

FIYR is built for this: a full money tracker with customizable categories, transaction rules, net worth tracking, and budgeting that doesn’t collapse the first time you buy plane tickets.

Day 2: Connect accounts and define your “real money”

Connect whatever you actually use:

- Checking and savings

- Credit cards

- Loans (if applicable)

Beginner rule: If it affects your cash flow, it belongs in your system.

Day 3: Create a beginner category structure (simple and sane)

Use a three-part structure:

- Fixed: rent, insurance, loan payments

- Flexible: groceries, gas, dining

- Future you: savings, debt payoff, investing

If you want a full framework, this pairs well with: How do you make a monthly budget that sticks?.

Day 4: Clean up your categories (before you budget)

Here’s the part nobody talks about: dirty categories create fake insights.

If “Amazon” is a category, your budget is basically fan fiction.

Common cleanup moves:

- Split big merchants into real categories (Amazon, Target, Costco)

- Treat credit card payments correctly (so you don’t double-count spending)

For credit cards specifically, read: Smarter budgeting with credit cards.

Day 5: Add labels for one-off life events

Labels are your secret weapon. Categories are for repeatable patterns. Labels are for context.

Examples:

- “New York Trip 2026”

- “Moving”

- “Wedding Season”

This is how you avoid nuking your grocery budget because you hosted Thanksgiving once.

Days 6–7: Do your first Weekly Money Check-In

Set a timer for 15 minutes.

Your script:

- “What did I spend this week?”

- “What surprised me?”

- “What do I need to change before this turns into a problem?”

This habit is so powerful it deserves its own neon sign. If you want the version that can save you real money, read: Why you’re overspending (and the one habit that could save you $50,000).

Quotable truth: You don’t need willpower. You need receipts and a calendar reminder.

Days 8–14: Build guardrails (so you can spend like a human)

Now that you have data, you get to do the fun part: telling your money what to do.

Step 1: Set flexible category caps based on reality

Use a simple baseline method:

- Look at the last 30 to 90 days

- Take the average for key flexible categories

- Set the cap slightly below average (5% to 10%), not 50% below because you watched a frugality TikTok

If your dining average is $320, setting $75 is not ambition. It’s fiction.

Step 2: Create a “Flex Pool” to absorb chaos

Beginners fail because the first surprise expense blows up the whole month.

Create a category called:

- “Flex Pool”

- “Stuff I Forgot”

- “Life Happens”

Fund it with a small amount. Even $50 to $200 helps.

Step 3: Run a subscription audit (your budget’s silent assassin)

A lot of people aren’t broke. They’re just subscribed.

Do this:

- Identify every recurring charge

- Cancel the ones you forgot existed

- Downgrade the ones you “might use again” (a lie you tell yourself monthly)

FIYR’s subscription tracking is built for this, because recurring charges should not be playing hide-and-seek in your transactions.

Step 4: Start tracking your savings rate (the FIRE-friendly metric)

Even if you’re not “doing FIRE,” savings rate is the clearest scoreboard for whether your budget is working.

Basic formula:

Savings rate = (Income − Expenses) ÷ IncomeIf you want benchmarks and definitions, read: What is a good savings rate? Real benchmarks.

Quotable truth: Your savings rate is your future freedom, expressed as a percentage.

Days 15–21: Automate the boring parts (because you have a life)

This week is about turning your budget from a “project” into infrastructure.

Automate categorization with rules

Rules are simple: if transaction matches X, categorize as Y.

This is how you stop re-categorizing the same merchants forever.

If you want to go deep: Spending rules automation.

Practical starter rules you can steal:

- All paychecks go to Income: Paycheck

- Starbucks goes to Dining: Coffee

- Netflix, Spotify, iCloud go to Subscriptions

- Uber and Lyft go to Transportation: Rideshare

In FIYR, automatic transaction rules plus custom categories are what make this feel less like a second job.

Monthly-ize your “true expenses” (aka stop being shocked by annual bills)

True expenses are irregular but predictable: car insurance, annual renewals, gifts, travel, school fees.

Simple method:

- Take the annual cost

- Divide by 12

- Save that monthly amount in a sinking fund category

Example: $600 car insurance every 6 months means $1,200 per year, so save $100 per month.

This is how you stop “surprises” that are literally on a calendar.

Add a safe-to-spend guardrail

A beginner-friendly way to avoid overdraft vibes:

- Keep a small buffer in checking (your “sleep-at-night minimum”)

- Know what bills are still coming before your next paycheck

- Don’t treat your checking balance like it’s free money

FIYR supports goal tracking and safe-to-spend style planning, which is basically a polite way of saying: “You can buy the sneakers, but rent still exists.”

Quotable truth: Checking balance is not a permission slip. It’s a snapshot.

Days 22–30: Close the month like a pro (without the shame spiral)

This is where most beginners either level up or rage-quit.

A budget doesn’t work because it’s perfect. It works because you review and adjust.

The 30-minute month-end close (copy/paste this)

Do this once a month:

- Confirm all transactions are categorized correctly

- Check the big three: housing, transportation, food

- Review subscriptions and recurring charges

- Compare budgeted vs actual (variance)

- Pick 1 to 2 changes for next month

If you want to keep categories clean long-term, this helps: Error-proof budgeting: how FIYR keeps spending categories clean.

A simple “next month” adjustment table

Use this to make changes without overthinking.

| What happened this month | What it means | What to change next month |

|---|---|---|

| You blew past Dining | Cap is unrealistic or rules are missing | Raise cap slightly or add friction (24-hour rule) |

| Groceries spiked | You are feeding more humans than planned | Increase groceries, reduce another flexible category |

| You forgot an annual bill | True expenses not funded | Add sinking fund and monthly amount |

| Your savings rate is near zero | Fixed costs too high or leaks everywhere | Start with subscriptions, then renegotiate big bills |

And yes, the goal is progress, not perfection. Perfection is how people end up with five budgeting apps and no results.

Quick fixes for common beginner problems

“I have irregular income. A monthly budget hates me.”

Monthly budgets don’t hate you. They just need a buffer.

Do this:

- Base your budget on a conservative income number (your low month)

- Build a one-month buffer over time

- Use sinking funds for taxes and irregular costs

If that’s you, read: Budgeting with irregular income.

“I keep overspending even with a budget.”

That’s not a math issue. That’s a behavior and friction issue.

Start here: How to stop impulse spending: a behavioral reset for 2026.

“My partner and I can’t agree on anything.”

Totally normal. You’re two different people with two different money stories.

Use a system built for trust, not mind-reading: Budgeting for couples.

The beginner checklist (if you only remember one thing)

If you want the 30-day plan in one punchy snapshot, here it is:

- Track first, budget second

- Keep categories simple

- Cap flexible spending using your baseline

- Audit subscriptions

- Fund true expenses monthly

- Automate categories with rules

- Weekly check-in (10 to 15 minutes)

- Monthly close (30 minutes)

Quotable truth: The point of budgeting is not to feel guilty. It’s to feel in control.

Frequently Asked Questions

Do I need a budgeting app, or can I do this with a spreadsheet? You can do it with a spreadsheet, but most people quit because it’s manual and easy to break. An app helps by automating imports, categorization, and recurring tracking so you can focus on decisions. What’s the best budgeting method for beginners? The best method is the one you’ll actually maintain. For most beginners, a simple three-bucket setup (Fixed, Flexible, Future) plus weekly check-ins beats complicated zero-based plans that require constant babysitting. How much should I budget for fun stuff? Enough to keep you from rebelling. If you set “fun” to $0, you’re basically designing a future impulse spending event. Give it a cap, track it, and spend it on purpose. How do I stop forgetting annual or irregular bills? Turn them into monthly sinking funds by dividing the annual cost by 12. Track the category monthly so the bill day feels boring instead of catastrophic. What should I do first if I’m living paycheck to paycheck? Start by getting ground truth, then cut recurring leaks (subscriptions), then build a starter emergency buffer. Even $500 to $1,000 changes the game, because chaos gets expensive fast.Build your first 30-day budget in FIYR (without the spreadsheet suffering)

If you’re serious about sticking with this, make it easy on yourself.

FIYR is designed for people who want modern money tracking and budgeting, especially if you’re an ex-Mint user who’s done with messy categories and half-true insights. You can track income, expenses, subscriptions, net worth, and savings rate, build flexible budgets with custom categories, and automate the boring parts with transaction rules.

Get started with FIYR and turn this 30-day plan into a system you actually keep using: FIYR personal finance platform.