Smarter Budgeting With Credit Cards: How to Avoid Fees and Track Spending Cleanly

Most people swear off credit cards because they think plastic wrecks budgets. Wrong villain. The real budget killer is messy tracking. A 2 percent cashback card will not save you if you are paying 22 percent interest and double‑counting payments like it is Black Friday math.

The mini‑story that will feel uncomfortably familiar

Meet Jordan. Ex‑Mint user, two cards, solid job, and a budget that looked fine on paper. Except his spending “felt high.” He was right. His app counted the $1,200 in card charges as groceries, gas, and dining, then counted the $1,200 card payment as “Bills.” Boom, instant double spend. Add in three Amazon orders tagged as “Shopping” when half the cart was pantry staples, a missed refund that showed up as income, and an annual fee hiding under “Misc.” That tidy $2,800 budget was actually $3,400.

After he cleaned up his category mapping and set autopay to pay in full, the phantom overspend vanished and his savings rate jumped 4 points. Moral of the story: credit cards are fine, sloppy systems are not.

The data reality check

- The average APR on credit cards recently topped 22 percent according to the Consumer Financial Protection Bureau, which means carrying a balance obliterates rewards fast. CFPB Report

- 60 percent of Americans live paycheck to paycheck, so frictionless swipes plus fuzzy tracking is a dangerous combo. CNBC

- The average credit card balance in the U.S. sits around the six‑thousand‑dollar mark, per 2023 consumer credit reviews. Experian State of Credit

Translation, rewards are nice, precision is necessary.

What breaks budgets when you use credit cards

Here is the part nobody talks about.

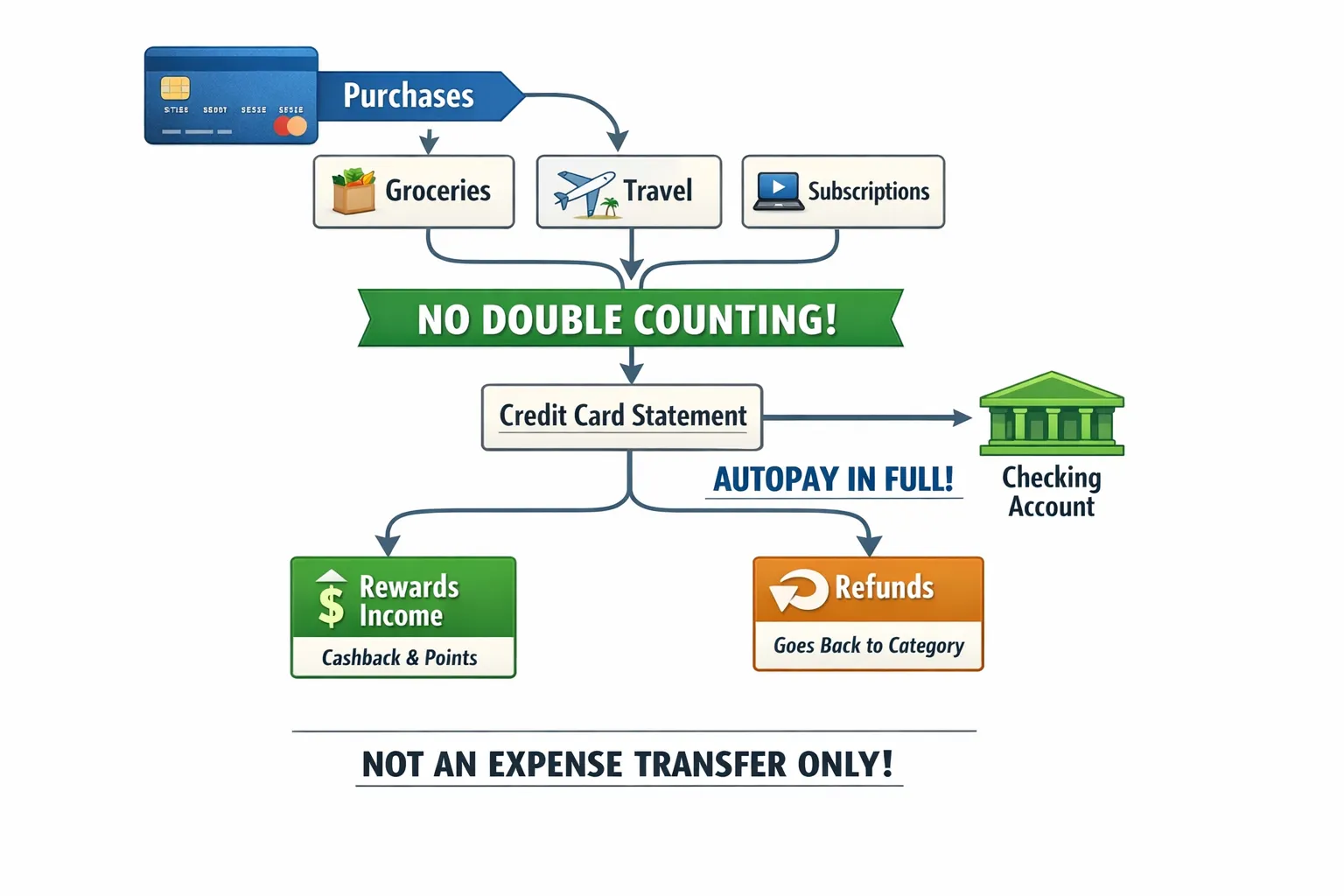

- Double counting payments, recording the purchase as spending, then logging the card payment as spending again.

- Treating refunds as income, which inflates your savings rate and lies to your face.

- Amazon blob transactions, one order that is five categories, all dumped into “Shopping.”

- Interest, fees, and FX charges disappearing in “Misc,” which hides the real cost of using the card.

- Statement cutoffs not matching calendar months, so a December budget includes November dinners.

- Business and personal swipes on the same card. Your tax prep and sanity both cry.

- Subscriptions you forgot three address changes ago. Recurring $9.99s are termites, not pets.

Your fix is simple, treat the credit card like a passthrough wallet. You categorize the purchase when it happens, you do not categorize the payment, and you keep fees and rewards visible.

The clean‑mapping cheat sheet

| Situation | How to record | Category tip |

|---|---|---|

| Purchase at grocery store | Expense on transaction date | Groceries |

| Credit card payment from checking | Transfer between accounts | No budget category, prevents double counting |

| Interest or annual fee | Expense when posted | Fees and Interest (track separately) |

| Refund or return | Negative expense | Same category as original purchase |

| Rewards cashback credit | Income or negative expense | Category “Card Rewards,” do not bury it in Misc |

| Foreign transaction fee | Expense | Fees and Interest, not Travel |

| Balance transfer fee | Expense | Fees and Interest, and start a payoff plan |

| Amazon mixed cart | Split transaction | Groceries, Household, Gifts, etc. |

| Tip posted separately | Expense when posted | Dining, not Misc |

Quote this to yourself every month, payments are transfers, not expenses.

Budgeting with credit cards, and still winning rewards

Let’s optimize without playing the 12‑card circus.

- Start with a 2 percent flat‑rate cashback card as your default. Simple, predictable, and hard to abuse.

- Add one category card only if it maps to real spend you already do, for example 4 percent groceries if you have a family, or 3 percent dining if you travel for work.

- Know your break‑even on annual fees. If a card gives 5 percent vs your 2 percent baseline in a category and charges a 95 dollar annual fee, you need 95 divided by 0.03, roughly 3,167 dollars of category spend per year just to break even. If you spend less, skip it.

- Treat sign‑up bonuses as a one‑time windfall. Park them in savings or debt payoff, do not let them inflate lifestyle.

- Never chase a category. If you buy 1,000 dollars of stuff you did not need to earn 50 dollars of points, you did not earn 50 dollars. You paid 950 dollars.

And for the inevitable “but rewards,” here is the math. A 2 percent reward on 1,000 dollars is 20 dollars. Carry that balance for a year at 22 percent and you pay roughly 220 dollars in interest. Negative 200 dollar “reward.”

Avoiding interest like a pro

- Autopay the statement balance in full. Set it once, then verify every month.

- Keep utilization low. Credit models generally prefer you below 30 percent of your limit, and often below 10 percent for best results. Mid‑cycle payments help if you run expenses through the card. Experian on utilization

- Avoid cash advances. They start accruing interest immediately and often have higher APRs.

- If you already revolve, focus on the highest APR card first, the avalanche method, and stop adding new charges on that card. When useful and you have discipline, a promotional 0 percent balance transfer can buy time, but only with a payoff schedule and no new swipes on that card. See our guide to payoff strategies. Debt payoff methods

Your budget is not broken, your interest is.

The simple workflow for using credit cards responsibly

This takes less time than a coffee line on Monday.

- Set autopay to full statement balance for every card. If you cannot do that yet, set autopay to minimum, then schedule extra payments toward the highest APR.

- Connect all accounts to your tracker and designate credit cards as liabilities, not cash. Budgets should be based on purchases, not payments.

- Create clean categories and one “Fees and Interest” category. Add a separate “Card Rewards” income category.

- Build rules to auto‑tag, for example, your issuer name plus “Payment” gets marked as a transfer, Amazon splits are flagged for review, and your gym subscription is labeled as a recurring charge.

- Do a 10‑minute weekly review, split Amazon orders, match refunds to the original category, scan for new subscriptions, and pay an extra mid‑cycle amount if utilization is high.

- Close the month in 30 minutes, verify every card’s spending equals the category totals, interest and fees are visible, and payments show as transfers. Then move leftover cash to goals.

- Rinse, repeat, and once a quarter, prune cards you are not using. If a card’s rewards are not beating your baseline after the fee, you do not need it.

Here is a maxim worth tattooing on your home screen, charge everything you actually budgeted for, then pay it all off automatically.

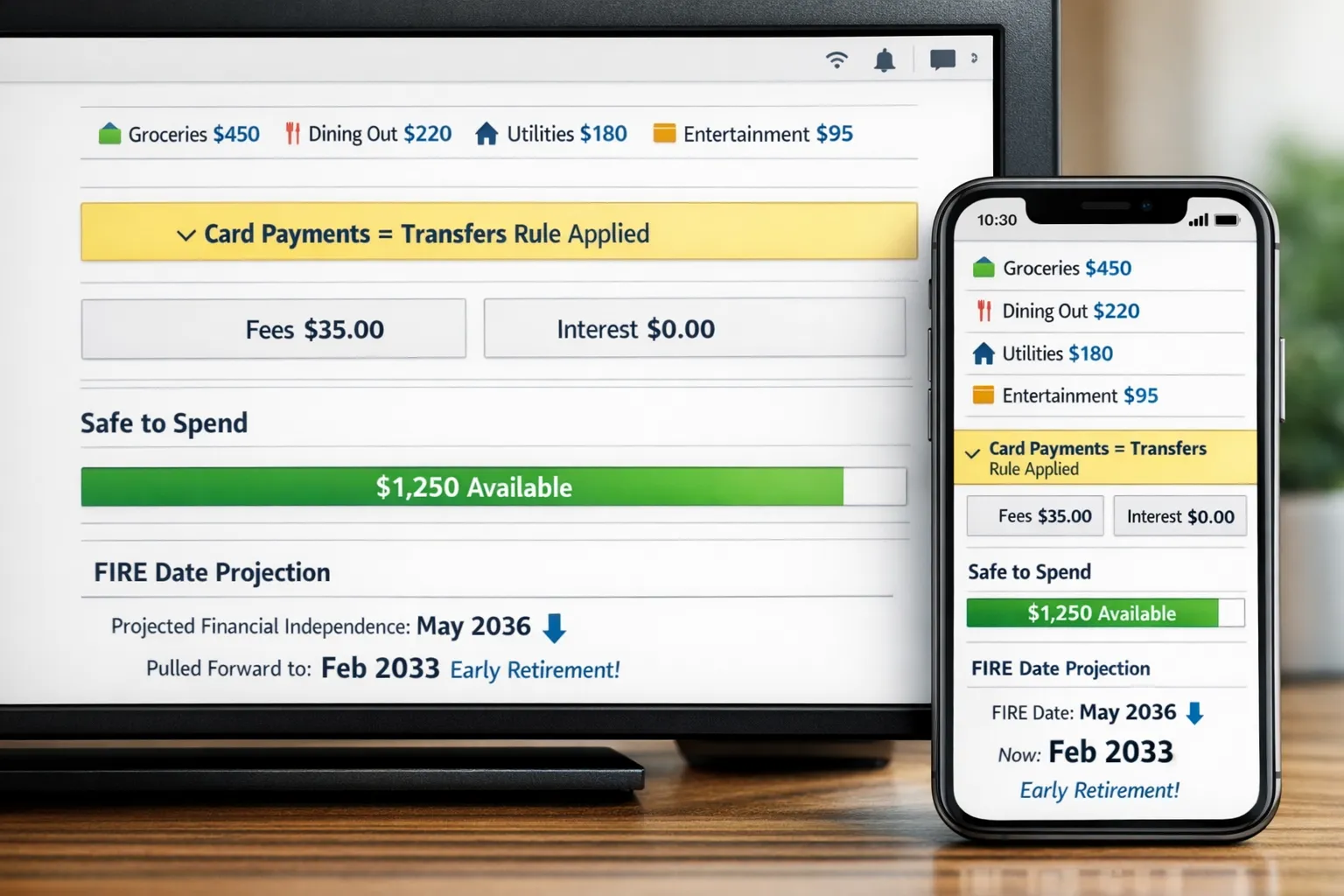

How FIYR keeps this clean without spreadsheet acrobatics

You can run this system anywhere. It is just easier in FIYR because it was built for people who want mastery, not mystery.

- Custom categories and groups so your spend reflects your life, not your bank’s idea of it.

- Automatic transaction rules that tag credit card payments as transfers, split Amazon orders, and keep refunds paired to the original category.

- Dynamic budgets with category caps and a safe‑to‑spend balance so you see limits before you cross them.

- Subscription tracking that surfaces recurring charges inside your budget, then helps you cancel or cap them.

- Labels for deep context, think “New York Trip 2025,” and a full cost rollup across cards and accounts.

- Savings rate and FIRE projections so you can see exactly how cleaning up card usage pulls your independence date forward.

If you are migrating from Mint or juggling multiple cards, FIYR gives you accurate spend, clean categories, and zero double counting without duct tape.

The “payments are transfers” playbook, step by step in FIYR

- Connect your checking and credit card accounts, make sure the card accounts are marked as credit, not checking.

- In Categories, add Fees and Interest, and Card Rewards under Income.

- Create rules, if Description contains “Payment,” mark as Transfer from Checking to Card. If Description contains “Annual Fee,” categorize as Fees and Interest. If Payee is “Amazon,” flag for review.

- Turn on subscription detection and review the list. Decide keep, cancel, or cap for each.

- Add labels for big projects, Wedding, Summer Camp 2026, Home Reno, to roll up true costs across categories and cards.

- In Budgets, set realistic caps using your 90‑day averages, then watch safe‑to‑spend to avoid end‑of‑month panic swipes.

Clean inputs, honest outputs.

Handling the ugly edge cases

- Statement timing, if your December budget includes late‑November dining because the post date is December 1, you are fine. Pick one rule, always use the posted date, and stick to it so your data remains comparable.

- Partial refunds, record them as negative expenses in the original category. If the refund lands in the next month, it still belongs to that month’s actuals, do not force it. The trend line will smooth it.

- Joint cards and authorized users, give each person a label, split transactions, and roll up totals by label for accountability without blame.

- Foreign travel, add a tiny “FX fees” line to your Travel category so you see the true trip cost. Do not hide it.

- BNPL, those installment charges on your card are still spending today. Treat them as the original category and avoid stacking new BNPL plans.

One more pro move, mid‑cycle payments are your secret weapon for keeping utilization low and cash flow visible.

Quick scripts and formulas you will actually use

- Annual fee math, break‑even spend equals annual fee divided by extra reward rate. Example, 95 dollars divided by 0.03 equals 3,167 dollars in that category to break even.

- Fee waiver script, “Hi, I have been a customer for X years, I like the card, but the annual fee is steep for my usage. Can you waive or credit it this year, or offer a no‑fee downgrade that keeps my credit line?” Then stop talking.

- Rewards discipline rule, redeem cashback monthly and sweep it to savings or debt. If it hits checking, it will mysteriously fund tacos.

A 30‑minute monthly close that makes the rest of the month easy

- Verify every card payment is a transfer, not an expense.

- Scan Fees and Interest, if you paid interest, pause and adjust behavior now.

- Split any blob transactions, especially Amazon.

- Match refunds to the original category.

- Review subscriptions, cancel one that no longer sparks joy or use.

- Check utilization, if above 30 percent near statement close, make a quick payment.

- Roll leftover cash to goals, emergency fund, debt payoff, or invest.

Do this and your budget stops swinging like a crypto chart.

Why this matters for FIRE, not just for neat spreadsheets

Every percentage point you claw back from interest and phantom spending drops straight to your savings rate. Push savings rate up by 10 points and you can shave years off your independence date. That is not motivational poster talk, it is the math underpinning every serious FIRE plan.

Oh, and by the way, FIYR shows your savings rate and FI date alongside your card spending, so you can see the cause and effect in real time.

The punchline

Credit cards can be a scalpel or a grenade. Use them to slice your spending with precision, not to blow up your budget. Map categories cleanly, pay in full automatically, keep fees and interest visible, and treat rewards as a bonus, not a business model. Do that, and plastic becomes a powerful tool on your path to financial independence.

Related reading:

- Error‑proof categories and rules, our full guide to clean data. Error‑Proof Budgeting

- Choose your debt payoff strategy and kill interest for good. Snowball vs Avalanche