Spending Tracker App Checklist: What to Demand

Most “budgeting apps” aren’t budgeting apps.

They’re pretty dashboards sitting on top of messy data, quietly telling you everything is fine while your checking account is doing parkour.

And this matters because the stakes are not aesthetic. CNBC reported that 60% of Americans are living paycheck to paycheck, and 61% are in credit card debt. When the margin is that thin, “close enough” tracking is how you wake up with a surprise overdraft and a personality shift.

Meet Sarah.

Sarah has a solid job, a decent salary, and the emotional support habit of buying “little treats” after every meeting that could have been an email. She downloads a spending tracker app to “get serious.” Two weeks later, the app says she spent $312 on “Shopping.”

Great. Helpful. Totally not a crime scene.

What she needed wasn’t another pie chart. She needed truth, in a format her brain can actually use.

So if you’re shopping for a spending tracker app (especially if you’re a former Mint user, or you’ve been side-eyeing Monarch, Copilot, Rocket Money, or Quicken), here’s the checklist of what to demand.

The real job of a spending tracker app: reduce self-deception

Your financial life has three enemies:

- Frictionless spending (one tap checkout, Apple Pay, “Buy Now Pay Later” being marketed like it’s vitamins)

- Subscription creep (the modern version of slowly gaining weight without noticing)

- Bad data (the silent killer, because it makes you confident and wrong)

A good spending tracker does one thing exceptionally well: it turns chaotic transactions into clean decisions.

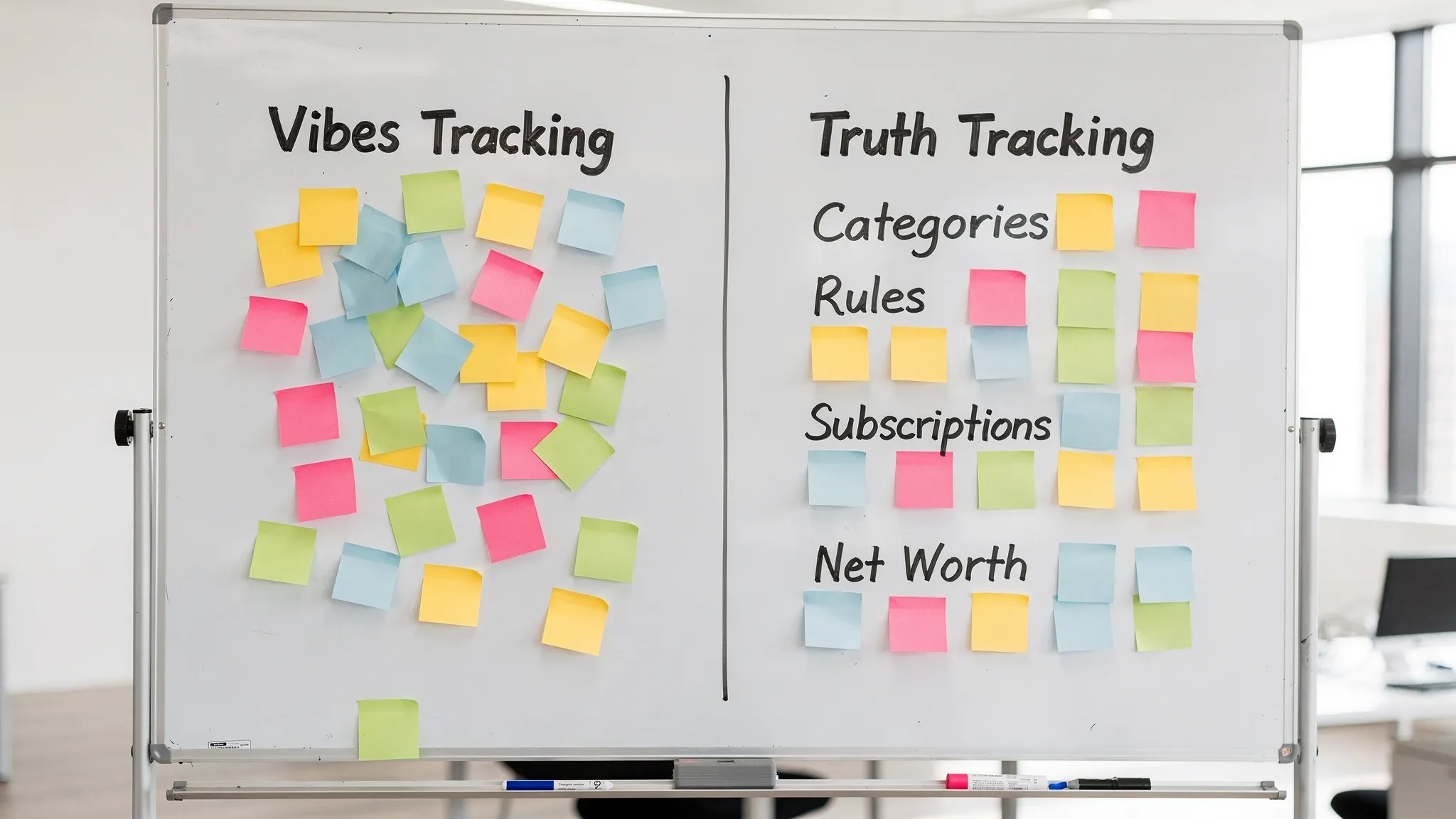

Anything else is just vibes. And vibes do not pay off debt.

Spending tracker app checklist: what to demand (non-negotiables)

This is the part where most reviews get cute and start ranking UI colors. We’re not doing that. We’re judging apps like a skeptical CFO.

1) Data integrity that does not lie to your face

If your tracker double-counts transfers, misreads credit card payments, or turns refunds into “income,” your budget becomes performance art.

Demand these basics:

- Correct handling of transfers (checking to savings, credit card payments, Venmo/Zelle moves)

- Pending vs posted clarity so you do not “spend twice” in your head

- Duplicate detection and a way to merge or exclude transactions

- Fast editing when something imports wrong

- A review workflow for uncategorized or suspicious transactions

A quick test-drive question: Can I reconcile my month-end cash flow without exporting to a spreadsheet and crying?

If not, keep shopping.

If you want a deeper look at why category hygiene is everything, bookmark this: Error-Proof Budgeting: How FIYR Keeps Spending Categories Clean.

2) Categorization that is customizable (not “one size fits nobody”)

Most apps force you into their worldview.

That’s adorable, like a toddler insisting dinosaurs are real (they were) and that your internet bill belongs in “Fun” (it does not).

Demand:

- Custom categories and category groups (you need structure that matches your life)

- Splits for big-box chaos (hello, Target receipt with groceries + socks + toothpaste + a candle you did not need)

- Merchant-level editing so “AMZN Mktp” does not become a single black hole category

- Labels or tags for projects and seasons (example: “New York Trip 2025,” “Baby Year 1,” “Kitchen Remodel”)

FIYR’s angle here is simple: you can build categories that reflect your actual priorities, then enforce them with rules and cleanup workflows, instead of manually fixing the same merchants forever.

Here’s the quotable truth: You don’t need more discipline, you need fewer classification errors.

3) Rules and automation that save time (and prevent relapse)

If a spending tracker requires daily manual labor, you will quit. Not because you’re lazy, but because you’re human.

Demand automation that actually works:

- Transaction rules (by merchant, keywords, and other predictable patterns)

- Auto-categorization you can override (automation should be obedient, not cocky)

- Consistency across time so reports don’t become nonsense

If you want to go full nerd (compliment), read: Automated Budgeting: How Rules Save Time and Keep Your Spending Accurate.

Cliffhanger transition: here’s the part nobody talks about.

Automation isn’t just convenience. It’s behavior change. When tracking is easy, you keep doing it. When you keep doing it, you actually improve.

4) Budgeting that fits real life, not a spreadsheet fantasy

A spending tracker app that only tracks spending is like a fitness watch that only measures donuts.

Budgeting features to demand:

- Flexible budgets (life is not monthly, and your bills do not care about your calendar)

- Category caps that help you run guardrails, not punishments

- Safe-to-spend logic (what you can spend without wrecking bills and goals)

- Goal tracking that connects day-to-day choices to the bigger plan

FIYR is built for this style of “budgeting that bends,” especially if your income is irregular or your expenses come in waves.

If you want the philosophy and framework, this pairs well: Flexible Budgeting: Build a System That Bends.

One-liner to remember: A budget that breaks on contact with reality is not a budget, it’s fan fiction.

5) Subscription tracking that exposes the sneaky leaks

The subscription economy is the gym membership model, scaled to everything.

You do not cancel because it’s expensive. You don’t cancel because you forget it exists. That’s the whole business model.

Demand:

- Recurring charge detection (not just a list you manually build)

- Subscription visibility inside your spending categories (so “Entertainment” isn’t a mystery stew)

- A way to audit renewals quickly and spot price hikes

FIYR includes subscription tracking as part of the broader picture, not as a separate app that treats your finances like a single problem.

If subscriptions are your financial kryptonite, this is a good follow-up: Best Apps to Manage Subscription Renewals.

6) Reporting that answers real questions (not trivia)

Charts are easy. Useful charts are rare.

Demand reporting that helps you make decisions like:

- “What categories are rising over the last 3 months?”

- “What did I spend on food at home vs restaurants?”

- “What’s my average monthly spend after removing one-offs?”

- “What changed this month, and was it worth it?”

Also demand:

- Clean income vs expense views (especially if you’re self-employed)

- Trend lines (because your problem is probably drift, not one bad week)

- Category group rollups (so you can zoom out without losing detail)

If the app can’t help you answer “what changed,” it’s not a tracker. It’s a scrapbook.

7) Net worth tracking (because spending is just the first domino)

If you care about financial independence, spending is not the end game.

Spending is the input. Net worth is the scoreboard.

Demand:

- Assets and liabilities tracking (not just “cash accounts”)

- A net worth timeline you can review monthly

- A way to include non-standard items if your life is not cookie-cutter (side business, car value, loans, manual assets)

FIYR ties day-to-day spending to longer-term progress, including net worth and FIRE-focused guidance.

If you want a quick refresher on the mechanics: How to Calculate Net Worth: A Simple Guide With Examples.

8) Savings rate and FIRE projections (if early retirement is even a “maybe”)

FIRE people love complicated spreadsheets.

But the cheat code is still the savings rate. Move it a little, and your timeline changes a lot.

Demand:

- Savings rate calculation based on real inflows and outflows

- A FIRE date or FI timeline tool that updates as your data updates

FIYR includes a FIRE date calculator based on your actual numbers, not on whatever you guessed while feeling optimistic on a Sunday.

One-liner: You can’t manifest financial independence, you have to measure it.

9) Control: exportability, privacy, and “I can leave anytime” energy

If an app traps your data, it’s not a product. It’s a roach motel.

Demand:

- CSV export (transactions, categories, reports)

- Transparent account connection options and clear permissions

- Security basics (multi-factor authentication where applicable, sane session handling)

- No dark patterns (naggy upsells, confusing “trial” traps, fake urgency)

Also consider the human side: if something breaks, do you have support, documentation, and a product that’s clearly maintained?

The 45-minute test drive: how to evaluate any spending tracker app

Do this once and you’ll never be fooled by a slick landing page again.

Step 1: Import enough history to reveal patterns

Aim for at least 60 to 90 days of transactions if possible.

You’re looking for:

- Missing accounts

- Duplicates

- Uncategorized piles

- Transfers misread as spending

Step 2: Pressure-test the “messy merchants”

Find your top offenders:

- Amazon, Walmart, Target

- Delivery apps

- PayPal, Venmo, Cash App

- Credit card payments

Then check whether you can:

- Split transactions cleanly

- Reclassify without breaking reports

- Build rules so you never fix the same thing twice

Step 3: Build a category structure that matches your brain

A simple structure that works for most people:

- Fixed bills

- Variable essentials

- Lifestyle

- Goals (debt payoff, emergency fund, investing)

- One-offs (travel, medical, home repairs)

If the app fights you here, it will fight you forever.

Step 4: Run the “month-end truth” report

Pick last month and answer:

- What did I spend (excluding transfers)?

- What were the top 5 categories?

- What changed vs the month before?

- What subscriptions hit?

If you can’t get these answers quickly, the app is a time vampire wearing a monocle.

Step 5: Check the habit loop

The best spending tracker app is the one you’ll still use in six months.

So ask:

- Can I do a weekly check-in in 10 to 15 minutes?

- Does it make it easy to spot problems early?

- Does it reduce decision fatigue?

If you want the weekly rhythm that actually sticks, this pairs nicely: Why You’re Overspending (And the One Habit That Could Save You $50,000).

Quick scorecard: the checklist in one view

Use this to compare apps without getting hypnotized by UI.

| Checklist area | What “pass” looks like | What “fail” looks like |

|---|---|---|

| Data accuracy | Transfers and card payments handled cleanly, duplicates manageable | Phantom spending, double-counted payments, messy imports |

| Custom categories | You can edit categories and group them your way | Locked categories, awkward defaults you can’t escape |

| Automation rules | Create rules once, benefit forever | You re-categorize the same merchants weekly |

| Subscription tracking | Recurring charges are visible and actionable | Subscriptions are hidden inside generic categories |

| Budgeting | Flexible caps, safe-to-spend, goals are supported | Rigid monthly budget that collapses with real life |

| Reporting | Trends, comparisons, and category rollups are easy | Pretty charts, no answers |

| Net worth + long-term | Assets, liabilities, and progress are trackable | Spending-only view with no bigger picture |

| Export + control | Data is portable, permissions are clear | You feel locked in |

Where FIYR fits (without the cringe sales pitch)

If you want a modern, customizable spending tracker app that’s also built for FIRE-minded people, FIYR is designed around the stuff that actually matters:

- Track spending, income, subscriptions, and cash flow in one place

- Create custom categories, category groups, labels, and transaction rules so your data stays clean

- Budget with flexibility, including safe-to-spend and goal tracking

- Track net worth (assets + liabilities) and savings rate

- Use FIRE-focused insights, including a FIRE date calculator driven by real user data

If you’re coming from Mint or bouncing between alternatives, you don’t need a “replacement.” You need an upgrade in how cleanly you see your life.

The bottom line

A spending tracker app should do more than show you what happened.

It should make it painfully obvious what to do next, without requiring a finance degree or a Sunday night spreadsheet séance.

Demand clean data. Demand customization. Demand automation. Demand reporting that answers adult questions.

Because the fastest way to go broke in 2026 is not inflation.

It’s being confidently wrong about your own numbers.