Budgeting for Families: Stop the Monthly Money Chaos

Your family doesn’t have a “budgeting problem.” You have a systems problem.

Because families don’t spend money like tidy little spreadsheets. Families spend money like a reality show.

- Soccer registration drops with the subtlety of a meteor.

- Daycare invoices hit like rent’s evil twin.

- Groceries somehow cost more every time, even when you swear you bought “the same stuff.”

And if you’re thinking, “Cool story, but we’re barely keeping our heads above water,” you’re not being dramatic. CNBC reported that 60% of Americans are living paycheck to paycheck, and money stress is basically a national hobby at this point (source).

Here’s the good news: budgeting for families isn’t about being perfect. It’s about being predictable. Predictable beats perfect every single month.

The real reason family budgets implode (hint: it’s not lattes)

Meet the Parkers.

Two incomes. Two kids. One dog who eats like he’s training for the Olympics. They “budget” the way most families do: they look at the checking account, feel a vague sense of dread, and promise to “tighten up next month.”

Then next month arrives with:

- A birthday party gift.

- A school fundraiser.

- A dentist copay.

- A surprise Amazon box nobody remembers ordering.

Their budget didn’t fail because they’re irresponsible. It failed because their money plan had no defense against surprise attacks.

Family finance isn’t chess. It’s Mario Kart. Random bananas everywhere.

The “Chaos Tax”: the hidden bill families pay every month

Most family budgets get wrecked by the Chaos Tax, which shows up in four flavors:

1) Calendar costs (the stuff you “forgot” is very real)

Annual renewals, school fees, camps, holidays, travel, car registration, home maintenance. None of it is surprising. And yet it always feels surprising.

2) Category soup

“Groceries” includes diapers, detergent, school snacks, and your spouse’s mysterious $11 sparkling water habit. When categories are mushy, your decisions get mushy.

3) Subscription creep

Streaming, apps, kids learning platforms, random memberships. You are one free trial away from funding someone else’s retirement.

4) Decision fatigue (also known as “I can’t think, just order takeout”)

Families make a million micro-decisions a day. By 6:30 pm, your brain is toast. Toast orders DoorDash.

Here’s the part nobody talks about: your budget must reduce decisions, not add to them.

The family budgeting system that stops the monthly money chaos

You don’t need 47 categories and color-coded shame. You need a simple operating system.

I like this framework because it scales from “one toddler, one income, mild chaos” to “three kids, two cars, and a calendar that looks like a war map.”

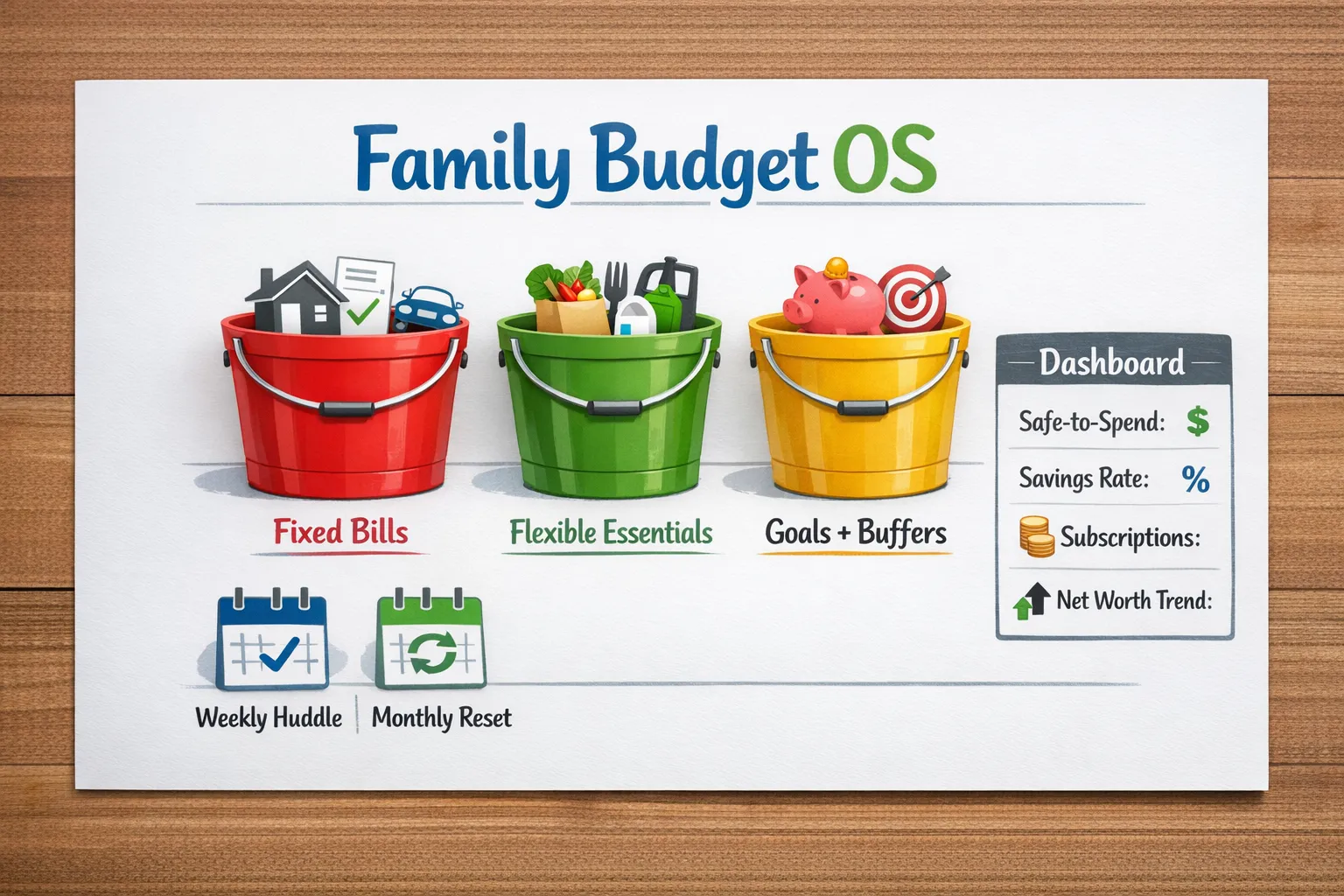

The Family Budget OS = 3 money buckets + 2 rhythms + 1 scoreboard

#### The 3 buckets

- Fixed Bills: mortgage or rent, insurance, childcare, minimum debt payments, utilities.

- Flexible Essentials: groceries, gas, household supplies, basic clothing.

- Goals + Buffers: sinking funds, emergency fund, investing, big goals.

Sinking funds are the secret weapon. They turn “surprise expenses” into “scheduled expenses.”

#### The 2 rhythms

- Weekly 15-minute Money Huddle: quick check, small corrections.

- Monthly 45-minute Reset: adjust caps, plan calendar costs, review what changed.

This is how you stop arguing about money. You replace vibes with a meeting. Romance.

#### The 1 scoreboard

Pick a few numbers that actually matter:

- Safe-to-spend (what you can spend after bills and plans)

- Savings rate (your FIRE lever)

- Subscription total (because it multiplies quietly)

- Net worth trend (direction matters more than perfection)

Budgets fail when they’re vague. Scoreboards are not vague.

A practical setup: do this once, then coast

This is the part where most advice gets weirdly moral. We’re not doing that. We’re building a machine.

Step 1: Get one month of “ground truth” spending

Pull the last 30 days of transactions and categorize them. Not for judgment, for reality.

If you’re a former Mint user, you already know the pain: messy merchants, duplicate categories, and “uncategorized” like it’s a lifestyle.

The goal is not perfection. The goal is clarity.

Step 2: Build a family category set that doesn’t lie

Most families do better with fewer, cleaner categories.

A solid starter set:

- Housing

- Childcare

- Groceries

- Transportation

- Utilities

- Insurance

- Debt payments

- Health

- Kids activities

- Dining out

- Shopping (aka “Target Events”)

- Subscriptions

- Giving

- Travel

- Savings and investing

If “Shopping” becomes a black hole, split it. A budget category that hides reality is just a permission slip.

Step 3: Turn calendar costs into sinking funds

Sinking funds are just expenses you admit exist.

Use the only formula you need:

Monthly sinking fund contribution = expected annual cost ÷ 12Here’s a simple table you can copy and fill in.

| Sinking fund | What goes in it | How to set the monthly amount |

|---|---|---|

| Back-to-school | supplies, clothes, fees | total expected cost ÷ 12 |

| Holidays + gifts | gifts, travel, hosting | total expected cost ÷ 12 |

| Car maintenance | tires, oil, repairs | total expected cost ÷ 12 |

| Home maintenance | small repairs, service calls | total expected cost ÷ 12 |

| Kids activities | uniforms, equipment, fees | total expected cost ÷ 12 |

When you do this, December stops feeling like a financial jump scare.

Step 4: Put caps on the “chaos categories”

Every family has 2 or 3 categories that blow up the plan. Usually:

- Groceries

- Dining out

- Shopping

- Kids activities

Put a cap on them and treat the cap like a guardrail, not a prison.

If you go over, don’t panic. Ask: what changed, and what do we want to change back?

Step 5: Create two rules that eliminate 80% of fights

Families don’t need 20 rules. They need two that everyone respects.

Pick two:

- The 24-hour rule for non-essentials over a set amount (you decide the amount).

- One-in, one-out for subscriptions (new one means an old one dies).

- Season budget for kids activities (because club sports can act like a second rent).

Rules are not restrictive. Rules are relief.

Step 6: Give money jobs (and make “random spending” earn a job)

Money without a job goes wandering.

Make sure every month includes:

- Fixed Bills covered

- Flexible Essentials funded

- Goals + Buffers funded

If something gets squeezed, squeeze it intentionally. Not by accident.

Step 7: Run the weekly huddle like a professional

Set a timer for 15 minutes.

Agenda:

- What categories are off track?

- What’s coming up in the next 7 days?

- Any weird charges or subscriptions?

- One small action for the week (cancel, adjust, move money)

You’re not “budgeting.” You’re running a household with a CFO meeting. Respect.

Why tools matter (because willpower is a scam)

A family budget is only as good as its data.

If your categories are messy, your decisions are messy. If your transactions are clean, your life gets weirdly calmer.

That’s the appeal of FIYR for budgeting for families: it’s built to be customizable and rules-driven, so the system sticks even when life gets loud.

With FIYR, you can:

- Track income and expenses with clean charts (so you’re not guessing)

- Use custom categories and category groups that match your family’s reality

- Set up automatic transaction rules (less manual cleanup, fewer “what is this charge?” arguments)

- Track subscriptions (and actually see the total damage)

- Watch savings rate and net worth over time (because families have goals bigger than this month)

- Use goal tracking and a safe-to-spend style approach to avoid accidental overspending

And if you’re coming from Mint, it’s a modern vibe: less clutter, more control.

A quick detour: learn from industries that treat money like a science

If you want a fun comparison, look at how transaction-heavy industries operate. Online gaming platforms, for example, obsess over rules, fraud prevention, and compliance because chaos is expensive.

It’s the same principle at home. Your household budget needs guardrails, automation, and visibility.

If you’re curious what “money systems at scale” look like, check out a modular iGaming platform like Spinlab. You’re not building a casino (hopefully), but the mindset is useful: tight systems beat good intentions.

The family budget isn’t just about surviving, it’s about buying back your future

Here’s the punchline most people miss: family budgeting is not about restricting joy.

It’s about removing the constant low-grade panic so you can:

- Say yes to the stuff you actually value

- Stop getting ambushed by “surprises” you could have planned for

- Build an emergency fund so the next curveball doesn’t go on a credit card

- Increase your savings rate (and move closer to financial independence)

Money stress is heavy. A good system makes it lighter.

If you want a related playbook for the “two adults, one plan” problem, FIYR also has a solid guide on budgeting for couples.

Frequently Asked Questions

What’s the best budgeting method for families? The best method is the one that survives real life. Most families do well with a simple bucket system (fixed bills, flexible essentials, goals and buffers) plus sinking funds for predictable “surprises.” How many budget categories should a family have? Enough to make decisions, not so many that you quit. Many families land around 12 to 18 categories, with extra clarity for the biggest problem areas (groceries, dining out, shopping, kids activities). How do sinking funds work for family expenses? You estimate an annual cost (like holidays, back-to-school, or car repairs) and save a monthly amount toward it. When the expense hits, you use the sinking fund instead of your credit card. How often should families review their budget? A 15-minute weekly check-in catches problems early, and a monthly reset lets you adjust for schedule changes, seasonal costs, and life events. What if we’re living paycheck to paycheck and can’t save yet? Start by building predictability. Track spending, cap the chaos categories, and create tiny buffers (even $25 to $50) so every surprise doesn’t become debt. Stability comes before speed.Ready to stop the monthly money chaos?

If your budget keeps collapsing under the weight of real life, don’t “try harder.” Build a better system.

FIYR makes that system easier to run because it combines spending tracking, budgeting, rules-based categorization, subscription visibility, net worth tracking, and FIRE-focused metrics in one place.

When you’re ready, start simple: track one month, set caps on the chaos categories, add 2 to 3 sinking funds, and run the weekly huddle. Then let the data do the arguing for you.

Because the goal isn’t to be a perfect budgeting family. The goal is to be the family that doesn’t panic on the 23rd of every month.